Online Commercial Finance Courses/Training for Non-Financial Managers

Commercial Finance for Non-Financial Managers

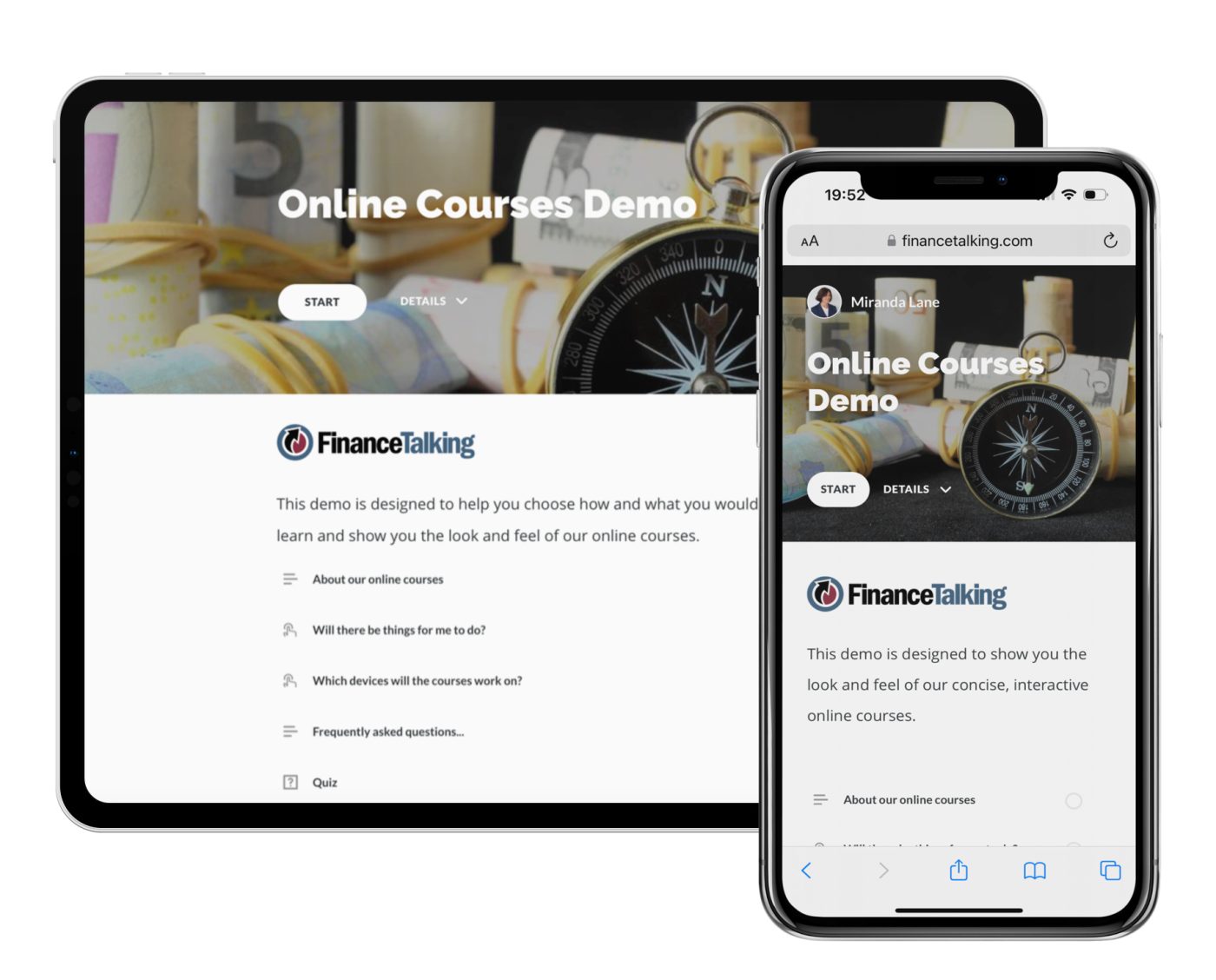

Online, On Demand Financial Training Courses

Online, On Demand Financial Training Courses

Learn at your own pace, anytime, anywhere with interactive online modules – including quizzes and knowledge checks to evaluate your progress.

We break down each course into bite-sized chunks so that you can do 5 or 10 minutes at a time on your smartphone, tablet or laptop anywhere you like so long as you have an internet connection and headphones.

Our personalised approach means that you can email or phone your tutor if you have questions. We will monitor your progress & send reminders when necessary.

Financial Management Online Courses

Understand income statements, balance sheets, budgeting & forecasting, investment appraisal and shareholder value – everything you need to become more financially astute with the following courses:

Get the first two Finance for non-financial managers courses with 10% discount

Get the first three Finance for non-financial managers courses with 10% discount

Get all five Finance for non-financial managers courses with 10% discount

Specialist Short Online Courses

Learn key aspects of finance with our short courses lasting approximately 30-60 minutes each.

Specialist Short Online Course

Approximately 60 minutes

Online Courses For Listed Companies

If you work in a listed company environment you may also be interested in the following courses:

Essentials Online Course

2-3 Hours Introductory Skills

We offer certificates for all our courses, including the online courses that we include to enable you to consolidate your learning.

Most CPD is now self-certified (e.g. accountancy, law etc) so we don’t offer CPD “points” for particular organisations. However, our courses would certainly meet most organisations’ CPD requirements.